After spending so much time and energy practicing medicine and building your wealth, you want to enjoy it in retirement and pass along the remainder to the next generation.

What impact will the 2018 Passive Investment Income rules have on your retirement planning? Have you considered the impact that taxes will have on the value of your estate when you pass away? Will your estate need to liquidate assets to fund tax liabilities upon your death?

Retirement and estate planning are complex and emotional processes with major financial consequences. Without proper planning, taxes can consume a significant portion of the funds available for your retirement as well as what is left in your estate when you pass away.

Death & Taxes – Understanding what happens to your assets when you pass away

In 1789, Benjamin Franklin famously said, “in this world, nothing is certain except death and taxes”.

As physicians, you already know the benefits of encouraging your patients to take preventative measures to avoid future health problems; it’s good advice for them. The same principle applies to you. As insurance professionals, we encourage our clients to be proactive with their estate planning.

Permanent life insurance plays a central role in the estate planning process because it protects and enhances the value of your estate.

The most efficient way to cover a future tax liability upon death is by purchasing permanent life insurance, which effectively transfers the risk away from the estate. This provides peace of mind while at the same time outperforming other alternative methods in terms of financial cost.

Permanent life insurance offers the following benefits:

- Guaranteed tax-free death benefit at the time when it is needed most.

- Maximizes the value of your estate.

- Inter-generational transfer of wealth in a tax efficient manner.

- Estate equalization.

Learn more about Permanent Life Insurance in Insurance Explained.

Mark’s approach is pleasantly personal. He is upfront; he thoughtfully answers my questions and takes the time to ensure I understand. Mark is easily accessible, and he will reach out with key dates if I am not on top of my milestones. I feel confident knowing that I have an expert in his field to go to when I need guidance for insurance planning needs, as can happen in periods of transition. This is a relationship we will have for the long-term, and Mark has invested in it from the beginning. I look forward to our meetings and I highly recommend his services.

Passive Investment Income Rules – Understanding their impact on your retirement and Professional Corporation

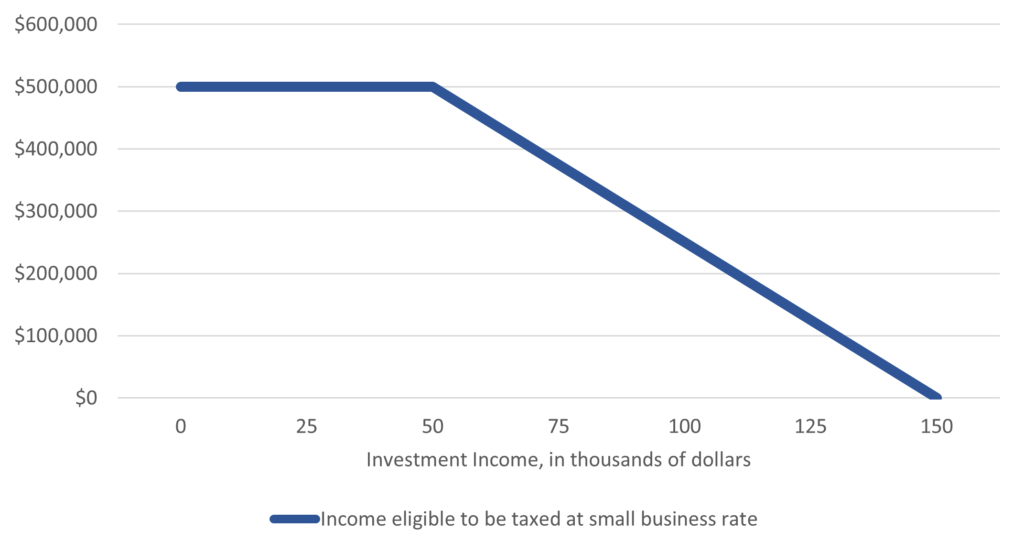

In 2018, the Federal government introduced new rules for passive investment income for Canadian Controlled Private Corporations (CCPCs). One of the groups hardest hit by the new rules was physicians.

The Solution – Corporately Owned Participating Whole Life Insurance

Life insurance can be structured corporately and provide a unique strategy to remove investments from the income threshold test. Participating Whole Life Insurance is an excellent savings vehicle using funds from your Professional Corporation to accumulate wealth in a low volatility environment as well as enhance your retirement & estate planning.

Benefits of Corporately Owned Participating Whole Life Insurance:

- Corporate Dollars – use corporate dollars that otherwise would have been subject to the Passive Investment Income rules.

- Tax Advantaged Growth – the growth of the cash value within a Whole Life policy is tax-exempt.

- Performance – the Participating Account (where premiums are deposited) has a strong history of stable and predictable performance, while at the same time providing low volatility.

- Guarantees & Vesting – as policyholder dividends are received, their cash values and death benefits are guaranteed and vest immediately, meaning they cannot decrease in value.

- Access to Cash Values – ability to access the cash value in your policy in a tax-efficient manner while you are alive.

Learn more about Life Insurance as an Asset Class & Corporately Owned Participating Whole Life Insurance in Insurance Explained.

Mark’s approach is pleasantly personal. He is upfront; he thoughtfully answers my questions and takes the time to ensure I understand. Mark is easily accessible, and he will reach out with key dates if I am not on top of my milestones. I feel confident knowing that I have an expert in his field to go to when I need guidance for insurance planning needs, as can happen in periods of transition. This is a relationship we will have for the long-term, and Mark has invested in it from the beginning. I look forward to our meetings and I highly recommend his services.