Life insurance is a financial tool that protects your family and loved ones from the financial impact of a premature death.

Life insurance has evolved and is also used for investment and estate planning purposes. We offer a broad selection of term, and permanent life insurance products to meet your needs.

Why do I need Life Insurance?

- You are engaged or married.

- You have children and/or other dependents.

- To protect against permanent problems like taxes and estate planning.

- You have a mortgage and/or other types of debt.

- You are looking for an efficient way to tax-shelter excess funds within your Professional Corporation or Holding Company.

- To transfer wealth to the next generation in a tax-efficient manner.

- To use as a strategy for investment or retirement planning.

- To fund the provisions of your business’ Buy-Sell Agreement.

- To provide cash-flow to your business in the event a Key Person dies.

What are the different types of Life Insurance?

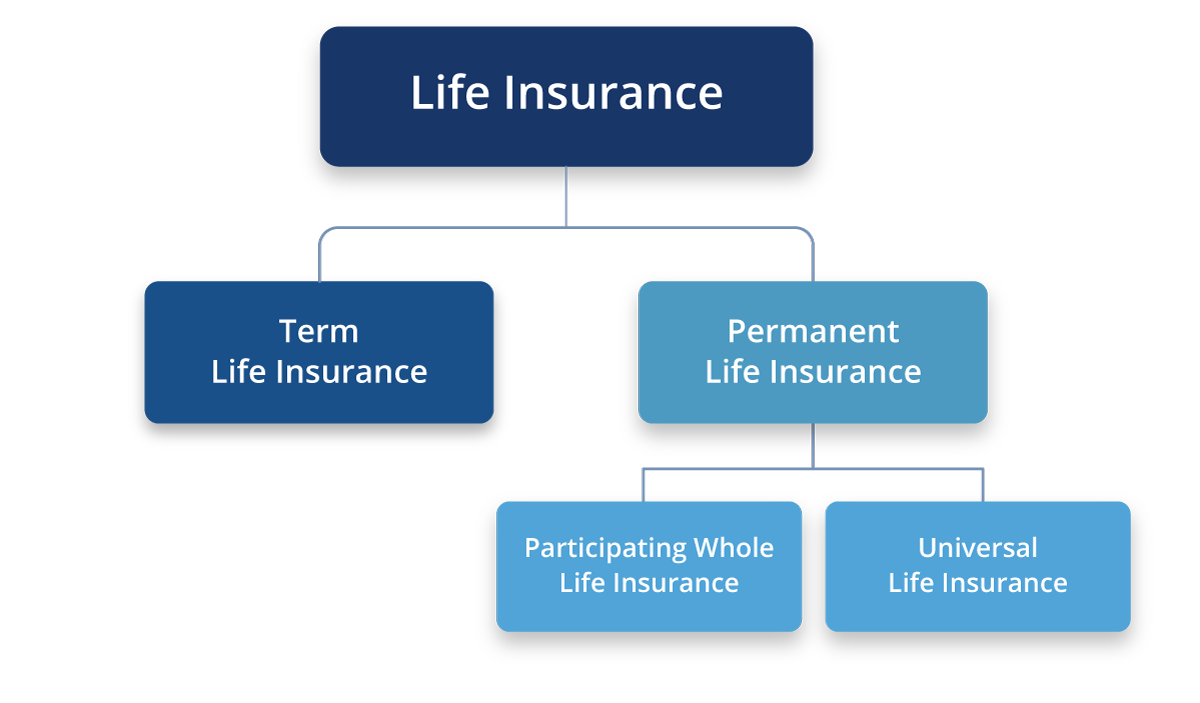

There are two main types of life insurance, Term Life Insurance and Permanent Life Insurance. Within Permanent Life Insurance, there is Whole Life Insurance and Universal Life Insurance.

Depending on your age, life stage and needs, you may need a mix of Term and Permanent Life Insurance.

Term Life Insurance

Term life insurance is a simple and flexible solution that protects against temporary problems such as debt elimination and replacing income for your family.

Permanent Life Insurance:

Participating Whole Life Insurance

Participating (PAR) Whole Life insurance is a type of permanent life insurance that provides lifetime coverage. PAR Whole Life insurance is a unique asset that combines permanent life insurance protection with a tax-advantaged investment component.

The premiums for PAR Whole Life policies are deposited into an account called a participating account. The insurance company manages this account and invests these premiums on behalf of policy holders. If the actual performance of the PAR account is better than the underlying assumptions made by the insurance company, the surplus is paid out to policy holders in the form of policyholder dividends.

A PAR whole life policy is currently classified by the Canada Revenue Agency (CRA) as an exempt life insurance policy for taxation purposes. As such, there is no income tax on accumulating policy reserves, the assignment of a policy to a bank as collateral for a loan is not a disposition for income tax purposes, and loans received by the policy owner may be tax-free.

Universal Life Insurance

Universal Life insurance is a type of permanent life insurance. It provides lifetime coverage with built-in flexibility.

Universal Life provides the traditional protection offered by life insurance, as well as the ability to invest in a tax-sheltered investment account. This type of coverage normally has guaranteed mortality costs, policy and investment expenses.

According to the Canada Revenue Agency, a Universal Life insurance policy is tax-exempt if it passes the annual exempt testing process. There is no income tax on accumulating policy reserves, the assignment of a policy to a bank as collateral for a loan is not a disposition for income tax purposes, and loans received by the policy owner may be tax-free.